3 Secrets To Developing The Superpower Of Belief

3 Secrets To Developing The Superpower Of Belief

Think you can, think you can’t; either way you‘ll be right.” ~ Henry Ford

I have a confession to make. I’m addicted to success. Actually, I’m obsessed by it. And if you knew the full extent of my story, you’d understand why!

After I suffered significant losses to my domestic and international investments right after the tech bubble of 2001, ended up unemployed for almost 18 months in which time real estate investment properties I held went into foreclose due to tenants not being able to pay their rent and my loss of income, I ended up filing bankruptcy. If I hadn’t had belief in God’s purpose for my life and his ability to turn my life around, I know I wouldn’t have ended up with a 7-figure net worth and over 6 figures in passive income just 5 years after my bankruptcy filing.

Needless to say, I’m a big believer in the superpowers of belief. If you are ready for a financially empowered life you can’t wait to live, one that’s designed around your purpose and that brings immense success, satisfaction and fulfillment beyond even your wildest dreams, one of your first steps will to develop the superpower of belief in you. To help you in that endeavor, I’d like to share 3 secrets to developing the superpower of belief.

THREE SECRETS TO DEVELOPING THE SUPERPOWER OF BELIEF

THREE SECRETS TO DEVELOPING THE SUPERPOWER OF BELIEF

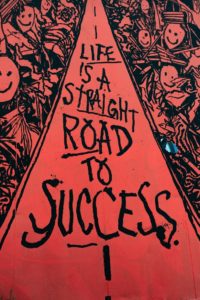

1. Think success, don’t think failure. Whether at work or in your home, substitute success thinking for failure thinking. When you face a difficult situation, think, “I’ll win,” not “I’ll probably lose. When you compete with someone else, think, “I’m equal to the best,” not “I’m outclassed.” When opportunity appears, think “I can do it,” never “I can’t.” Let the master thought “I will succeed” dominate your thinking process. Thinking success conditions your mind to create plans that produce success. Thinking failure does the exact opposite. Failure thinking conditions the mind to think other thoughts that produce failure. Disbelief is a negative power. When your mind disbelieves or doubts, the mind attracts “reasons” to support the disbelief. Simply put, think doubt and fail. Think victory and succeed.

2. Remind yourself regularly that you are better than you think you are. It’s been said that Mohammed Ali, the greatest boxer of all time, hired someone just to follow him around all day and tell him he was the greatest. What if you had someone following you around all day, whispering in your ear, you’re the best, no one can stop you, you’re the greatest, you’ve got this. Imagine the impact these words could have to your life. From Japanese researcher Dr Masaru Emoto we’ve learned that positive words positively impact water’s molecular structure and ability to form crystals, just as negative words negatively impact water’s molecular structure and its ensuing ability to form crystals. Dr. Emoto’s scientific research only proves what the Bible has long told us, that the power of life and death is in our tongues. What we say about ourselves and about our future has a directly correlation to the future we create for ourselves. You can watch a video on Dr. Emoto’s research on YouTube here at https://www.youtube.com/watch?v=bm0h3DXs6-4

Now, you have both biblical and scientific reasons to only speak positive words over yourself and to remind yourself that you are better than you think you are. Remember, successful people are just ordinary folks who have developed belief in themselves and what they do. Never – yes, never – Sell yourself short by speaking negative words over your potential and future.

3. Believe Big. The size of your success is determined by the size of your belief. Think little goals and you can expect little achievements. Think big goals and you can expect big successes. One last thing. Do remember that big ideas and big plans are often easier and certainly require no more effort than small ideas and small plans. That’s why Les Brown says to shoot for the moon and if you miss, at least you’ll be among the stars.

Sit with this, meditate on it, internalize it and when you become “ONE” with these 3 secrets to developing the superpower of belief, you’ll realize that you now possess the one thing within you that guarantees success in life. Those secrets I shared came from a book I highly recommend, The Magic Of Thinking Big, by David. J. Schwartz, PH.D

Needless to say, I’m a big believer in the superpowers of belief. I get the sense you might be too. And even if you don’t have the requisite amount of belief to live the life you’ve been waiting all these years to live, I’ve got good news for you. You can borrow my belief in you until you believe in yourself as much or more than I do. That’s one of many benefits clients get from a private coaching relationship with me. You can enjoy those same benefits as well if that’s something that’s of interest to you. Just take the assessment and then book a call so we can chat!

If you think you can create a financially empowered life you can’t wait to live, one that’s designed around your purpose and that brings immense success, satisfaction and fulfillment beyond even your wildest dreams, you can. If you think you can’t, just borrow my “you can” until it turns your “I can’t” to an “I can.”

That can happen easily and effortlessly for you by simply taking your first step and completing the assessment and then booking a call so we can chat!

Cheers to you thinking BIG!

With Abundance & Fulfillment,

Ike

Recent Comments